In a market that is well into the late stage of the cycle, what is needed are special diversification qualities. The quality of the location, which is mainly a function of good transport infrastructure, is given the highest priority. In addition, investments in existing properties have clear advantages over investments in new construction projects.

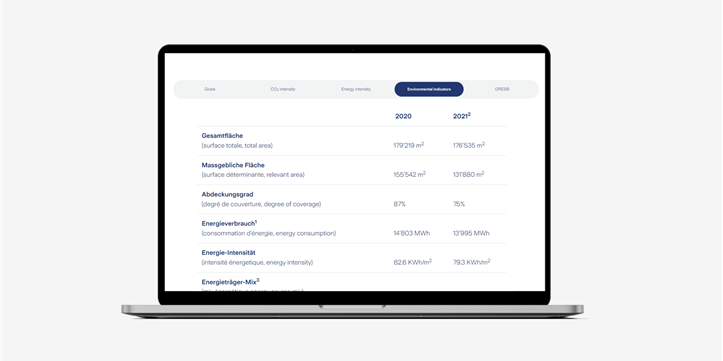

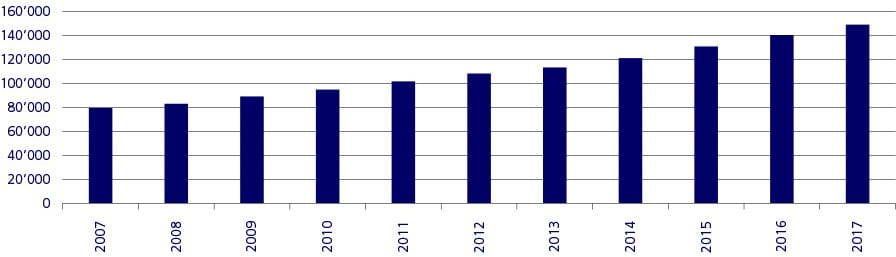

The increasing importance is shown, for example, in a statistic from the Federal Statistical Office FSO (Figure 1). The share of Swiss real estate in 2016 was 17 percent. The quality demands of investors have become more diverse.

Development of investments in Swiss real estate (in CHF million)

In particular, the demands on direct real estate investment no longer focus solely on attractive returns combined with the lowest possible risk. Transparency is at least as important to investors now. Finally, real estate complements the traditional asset classes, i.e. equities and bonds in an optimal way.

Has real estate peaked?

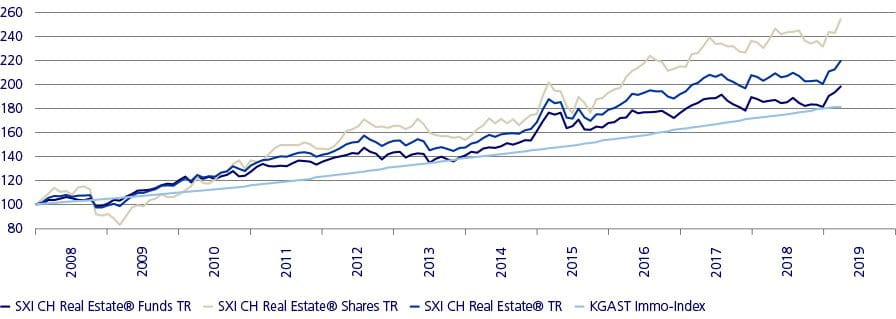

Since the financial crisis, the property market, measured by the SXI Real Estate indices and the KGAST Immo Index, has only known one direction - upwards (Figure 2).

Development of the Swiss real estate market

At the same time, the prices of other asset classes such as bonds, equities, infrastructure investments and private equity investments have also risen sharply.

Due to the continuing low interest rate environment, the difference between yields on real estate and 10-year German government bonds is tempting, making real estate attractive. In addition, from a historical perspective, this yield difference is relatively high and thus represents a certain buffer against any increases in interest rates. Since the Swiss National Bank (SNB) is sticking to its monetary policy and experts expect interest rates to rise only slowly, real estate remains a rewarding asset class.

Diversification with a focus on cities

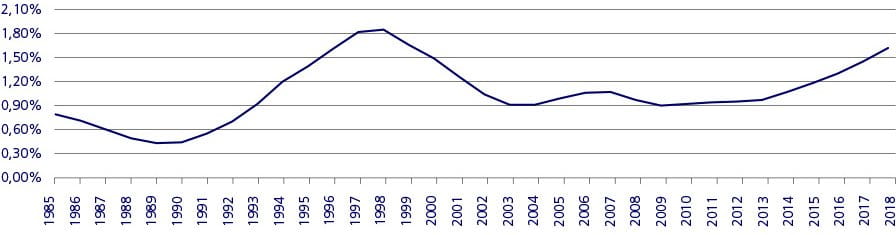

Institutional investors should broadly diversify their real estate investments. Nevertheless, when it comes to diversification, the devil is in the details and it should be viewed in a differentiated way. One aspect, for example, is regional diversification. This allows different economic areas to be covered. The other aspect is refinement within a large region, because if the vacancy rate rises (Figure 3), the FSO recommends investing in Switzerland's larger cities, such as Zurich, Lausanne, Geneva and Basel, rather than in peripheral locations.

Development of the vacancy rate

Properties centrally located in cities in prime locations are attractive to both tenants and investors. This concerns existing properties rather than new buildings that have yet to build a track record.

Existing properties present lower risks

Within real estate investments, assets are typically grouped into the risk categories core, core-plus, value-added and opportunistic (box: risk categories). The classification of a property is based on various key figures that make an objective risk assessment possible. The criteria include location, tenant structure, income, value appreciation, debt ratio and expected return.

In view of the development of the vacancy rate, it is preferable to invest mainly in high-quality existing properties in inner-city locations or in suburban districts with stable rental income and low risks. These core/core-plus properties are well-equipped, in prime locations and are typically fully let.

Diversification within the real estate life cycle

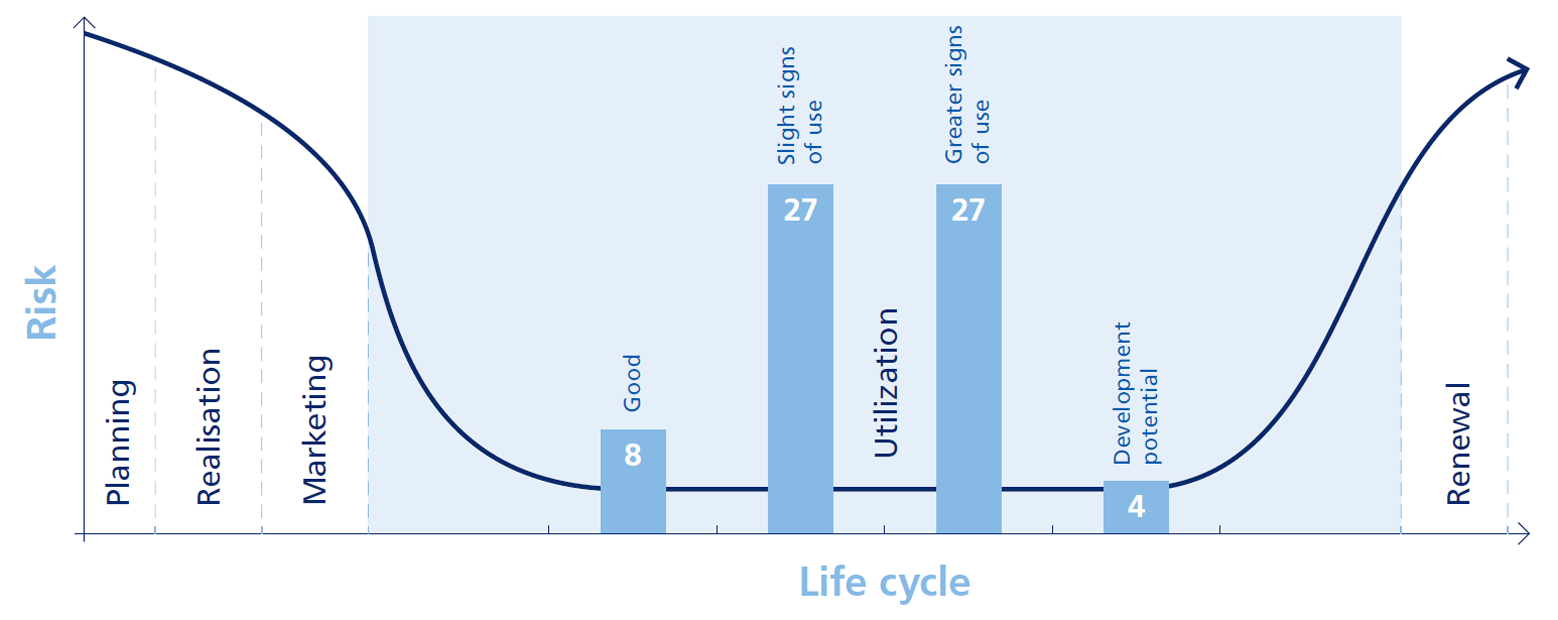

In addition to diversification with regard to the size of properties, the condition of a property is also relevant. The life cycle of a property comprises various stages. It begins with planning and project planning, continues with realization (construction) and sale and then moves on to the long period of use until the cycle starts all over again with the renovation or replacement of the building.

It is advisable to diversify properties over different stages within the property life cycle to allow for investments to be planned and made over a longer investment period. Real estate funds that have optimally distributed existing properties during the use phase, benefit from significantly lower risks (Figure 4).

Diversification in the real estate life cycle

New construction projects are exposed to major risks with regard to realization and sale and can result in high vacancy rates over an uncertain period of time.

Expert knowledge opens up opportunities

Thanks to their high investment volumes, institutional investors have good access to various investment opportunities across all markets. The challenge is to choose among the sheer range of real estate investments. Property-specific know-how, experience and a good network are important prerequisites for managing real estate, structuring, analyzing and executing transactions.

This expertise can be demonstrated by teams of real estate specialists consisting of economists, architects and lawyers. This opens up a unique opportunity for investors to gain a low-cost entry into a portfolio that is not only optimally positioned but also really well managed.

Real estate risk categories

- Core: Core real estate investments sit at the bottom of the risk ladder. Core properties are typically in prime locations in city centers and have quality tenants. These are high-quality portfolio properties with long-term earnings security and low vacancy rates.

- Core-plus: Core-plus properties are located in attractive suburban districts or larger municipalities with future development potential. They generate higher returns i.a. by sacrificing on location and property quality.

- Value-added These properties are located in unattractive locations with average-quality buildings, i.e. there is the opportunity to increase their value through renovation and realignment.

- Opportunistic: This risk category covers high-risk real estate investments in very difficult markets which, however, have a high potential for value appreciation.