What does ESG mean?

ESG stands for three sustainability-related areas in which companies have responsibilities:

- Environmental: Effects on the environment

- Social: Socially responsible actions

- Governance: Sustainable corporate governance

Active stewardship approach

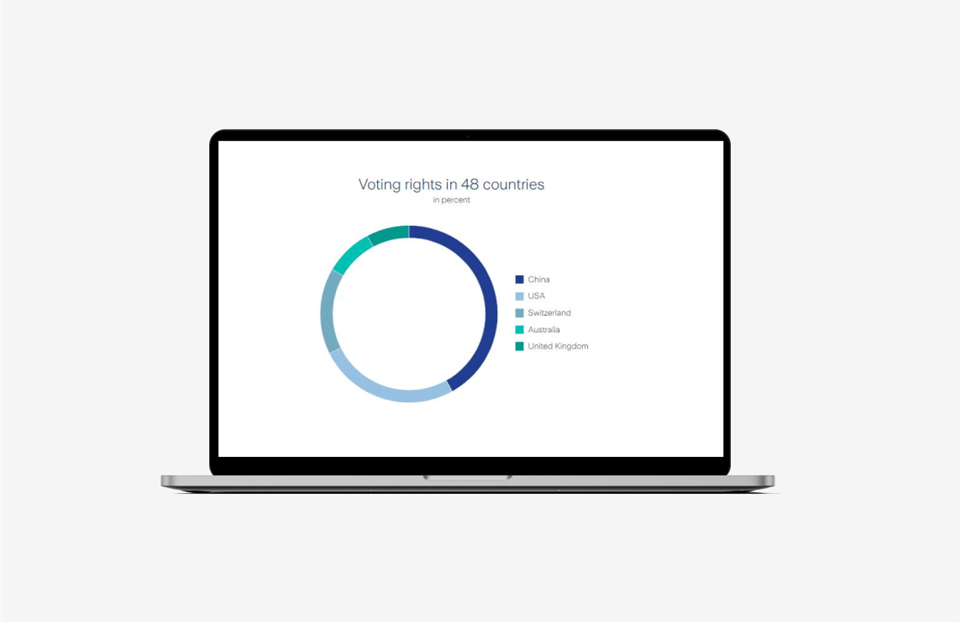

We follow an active stewardship approach that includes engagement and proxy voting. This allows us to respond flexibly to key sustainability issues that matter to our customers and to support companies in the sustainability sector in achieving better outcomes.

Our latest stewardship report

Our latest stewardship report

What does stewardship mean?

Stewardship means that investors use their influence as shareholders to promote responsible behavior. This includes engagement and the exercise of voting rights.

Contact

Fabio Oliveira

CESGA, Senior ESG Analyst

Christina Pillichshammer

Investment Analyst