Great demand for infrastructure

In the coming years, many countries will need to renovate or expand their infrastructure. In view of the limited state funding in many places, construction projects offer an attractive investment opportunity for pension funds. A lot of interesting offers are expected to hit the markets in the next few years. The World Economic Forum (WEF) estimates the global demand for infrastructure investments until the year 2035 at 3.7 trillion US dollar. The worldwide population growth, the increasing urbanization and mobility and various economic developments are opening the door to an immense demand for investments.

Rising investments

Rock-bottom interest rates are forcing pension funds to find new sources of income. For many Swiss pension funds, infrastructure is an attractive alternative. Currently, infrastructure investments by Swiss pension funds amount to more than 8 billion Swiss franc. This is evident from the pension fund statistics published by the Federal Statistical Office. Furthermore, recent observations show that demand is rising.

Investment challenges

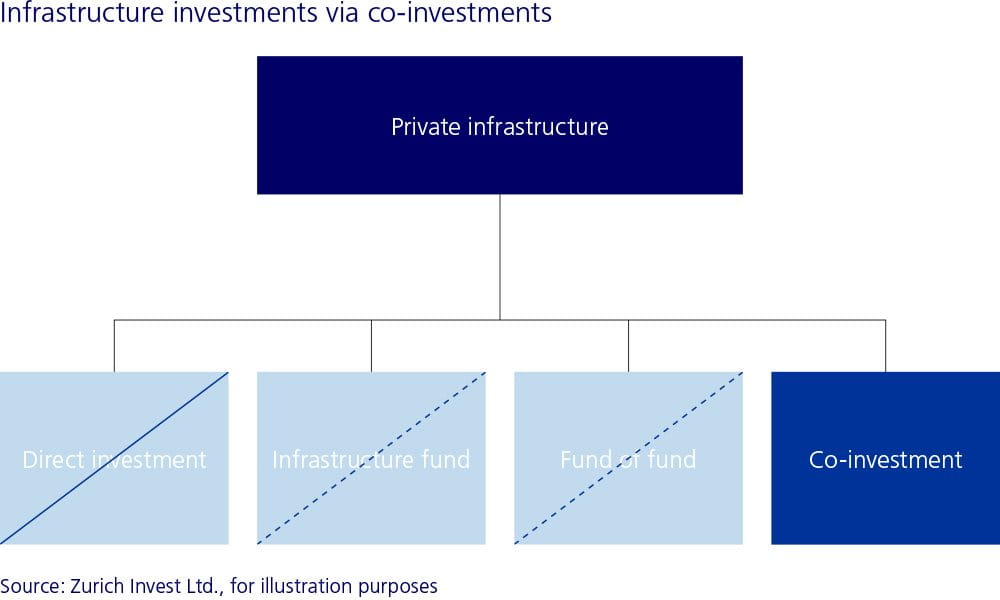

Swiss pension funds are aware of how attractive infrastructure is. However, the question remains how to successfully invest in infrastructure. Pension funds need to examine various subject areas. For example, which type of investments are better: brownfield or greenfield? Are the costs reasonable when compared to the expected returns? Would it be better to invest directly, via infrastructure funds, via funds of funds or via co-investment? Which vehicles give the investor full control?

Stability with brownfield investments

Brownfield infrastructure investments are operational projects. Normally, the risk-return profile is comparable to the risk-return profile of a real-estate investment. Therefore, these investments are especially suitable for investors who desire a constant cash flow as well as steady, foreseeable returns. Greenfield investments are projects that have just been initiated and that involve a substantial need for investment. Due to the potentially higher development risk, the risk-return profile of this type of investment is similar to the risk-return profile of a private-equity investment. These investments mainly aim at increasing the capital value. Defensive brownfield investments are recommended within the infrastructure universe, as they are already active and generate stable returns.

Cost efficiency is what counts

Costs are a key issue for Swiss pension funds. Firstly, infrastructure vehicles are often associated with fees that are aligned with private-equity investments, although the returns can differ greatly. Therefore, pension funds should make sure that the costs are reasonable in light of the expected returns. Secondly, closed collective investment vehicles that invest in infrastructure are often marked by what is called a J-curve effect. The J-curve describes what is typically a negative return and liquidity trend at first due to investments, fees and expenses, which gradually changes into a positive return and cash-flow trend after a few years. This J-curve effect can be reduced by systematically adding co-investments and by developing attractive alternative fee models. Pension funds should look out for an innovative, transparent and cost-efficient structure and benefit from management fees that are not based on the capital commitment, but on the capital invested.

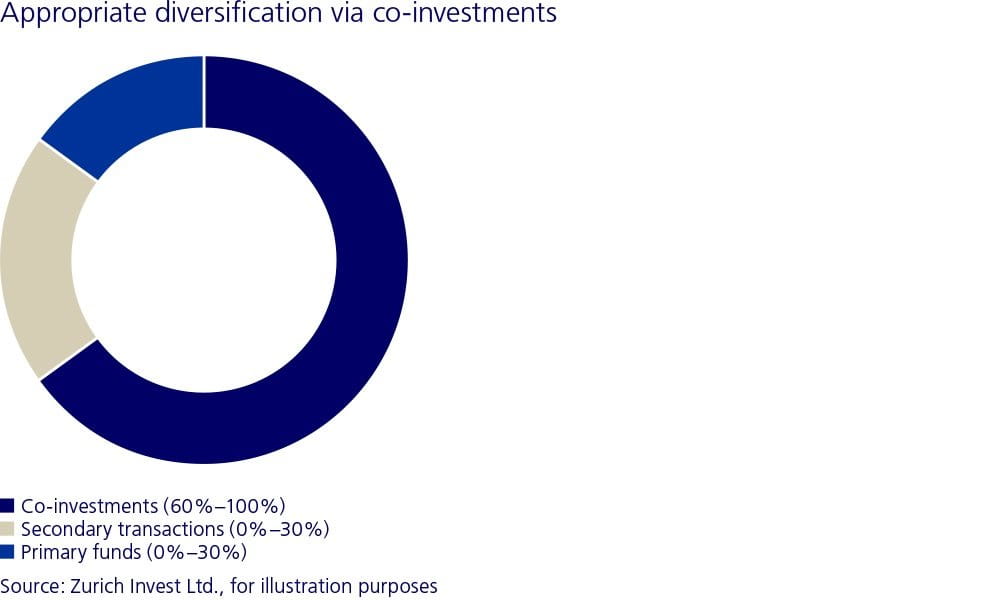

Diversification via co-investments

Pension funds should diversify their risks as broadly as possible. Thus, their infrastructure investments should be spread over various industries and regions worldwide. At the same time, it would be beneficial to include various co-investments for risk diversification purposes in order to expand the network over several areas and players, thereby reducing the dependence on a single investment case. Moreover, co-investments enable more systematic diversification than funds, without any additional costs.

Example of a co-investment

South Staffordshire Plc, based in Walsall, United Kingdom, is a service group that operates a regulated water company with two separate supply regions in Black Country northwest of Birmingham. Every day, the company supplies 330 million liters of water to about 500,000 households and 36,000 business customers. The company successfully offers a series of services in the British water industry and increasingly to other infrastructure owners as well. With South Staffordshire Plc, the investor has full cash-flow transparency and can expect a stable, long-term yield profile.

To choose a successful investment strategy in the huge field of infrastructure, pension funds might want to have a specialist carefully select the providers and conduct thorough due-diligence audits. A pension fund should also examine the transparency of an investment, tax aspects, the question of who controls the infrastructure investments at the operational level and whether a veto right exists for every investment.

The Infrastructure I and Infrastructure II investment groups each contain over 20 investments worldwide. Since their launch in 2013 and 2017 respectively, their performance has been positive. The well-known performance indicator or investment multiple "total value to paid-in" (TVPI) is calculated from the total value including distributions in relation to the capital paid in. A TVPI of more than 1 indicates a positive return over the holding period. Included in a portfolio, infrastructure investments can thus represent a highly effective investment option.