One strategic focus is on climate protection measures across all asset classes: This includes analyzing climate-related risks, actively influencing companies to reduce CO₂ and setting ambitious targets for net zero portfolios by 2050.

Investment foundations facilitate access

Switzerland is pursuing ambitious climate targets with its current CO₂ legislation. The building sector offers great potential for reducing emissions. However, it is challenging to manage the CO₂ footprint of a mortgage portfolio: Property owners make their own decisions about renovation measures. Willingness to renovate depends heavily on regulatory requirements, financial incentives and individual decisions. At the same time, there is an increased risk that real estate with inadequate energy efficiency will lose market value.

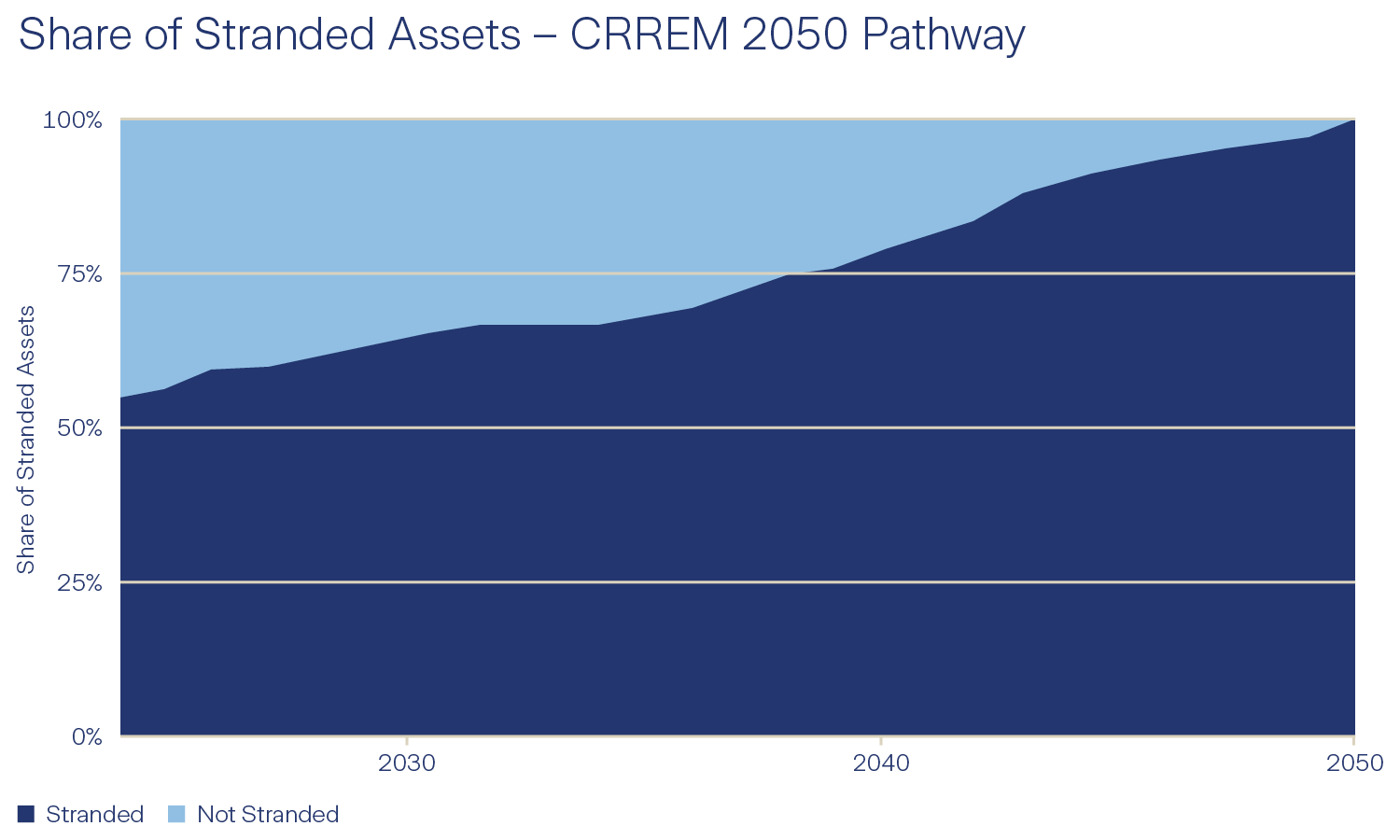

This risk is real: By 2050 at the latest, mortgage portfolios must comply with the permissible emission limits according to the 1,5-degree target of the CRREM. If they do not, the portfolios would be considered “stranded.” This would pose significant risks to performance, the collateral quality of the mortgaged properties, and regulatory compliance.

Zurich Invest has developed a three-stage action plan to manage the climate risks in Swiss mortgage investments. This is how sustainability becomes an integral part of the portfolio:

- CO₂ portfolio analysis for more transparency

In November 2024, the entire mortgage portfolio was analyzed for the first time with respect to CO₂ emissions and energy status. This was based on publicly available building data and internal mortgage information. This analysis has created transparency with regard to the ecological footprint of the financed properties. It forms the basis for measuring the achievement of sustainability goals. It also makes it possible to identify potential and risks. - Renovation calculator for borrowers

To actively promote energy-efficient renovations, Zurich Invest provides its borrowers with an individual renovation plan each time a product matures. This is created using a digital tool from Wüest Partner and forms the core of impact-oriented engagement: Zurich Invest Ltd. provides its customers with targeted support on the way to more climate-friendly properties.

The plan shows the current CO₂ emissions, forecasts their reduction over time as a result of refurbishment measures and shows when threshold values are undercut and better energy efficiency classes are achieved. Heat requirements, subsidies and tax savings are also shown. This creates a holistic overview that facilitates investment decisions and strengthens the sustainability and value retention of the portfolio. - Mortgage benefits for energy-efficient properties

From January 2026, mortgage borrowers will benefit from a financial advantage if their properties are in energy efficiency classes A to C. This creates strong incentives for energy improvements, regardless of the term or mortgage model. The criteria are based on the Wüest Partner Refurb standard, which is already used for portfolio evaluation.

With this action plan, Zurich Invest Ltd goes beyond traditional ESG integration: It creates concrete incentives and actively promotes climate protection measures.