Booming real estate prices

One of the characteristic developments for real estate investments in Switzerland is long-standing and persistently low interest rates. These are accompanied by real estate prices that have risen sharply since the global financial crisis. Measured by the SXI Swiss Real Estate Index, the Swiss real estate market, for example, has grown 7 percent over the past ten years, and in 2019 it experienced a real rally with a return of over 28 percent.

Saying goodbye to home bias

The demand for real estate continues to rise: the main reasons for this are the negative interest rates introduced by the National Bank in the institutional investor sector and the record low mortgage rates in the private sector. As a result, transaction prices have also risen visibly. There is often no way for pension funds to avoid overpaying for properties in order to win contracts in bidding processes. Does this mean you should say goodbye to home bias and diversify/refresh your portfolio? To answer this question, you need to take into account aspects such as the size and relevance of real estate markets, real estate market cycles, interest rate developments, currencies, liquidity, transparency, construction activities and demand, legal certainty and tax-related aspects.

Welcome to European diversification

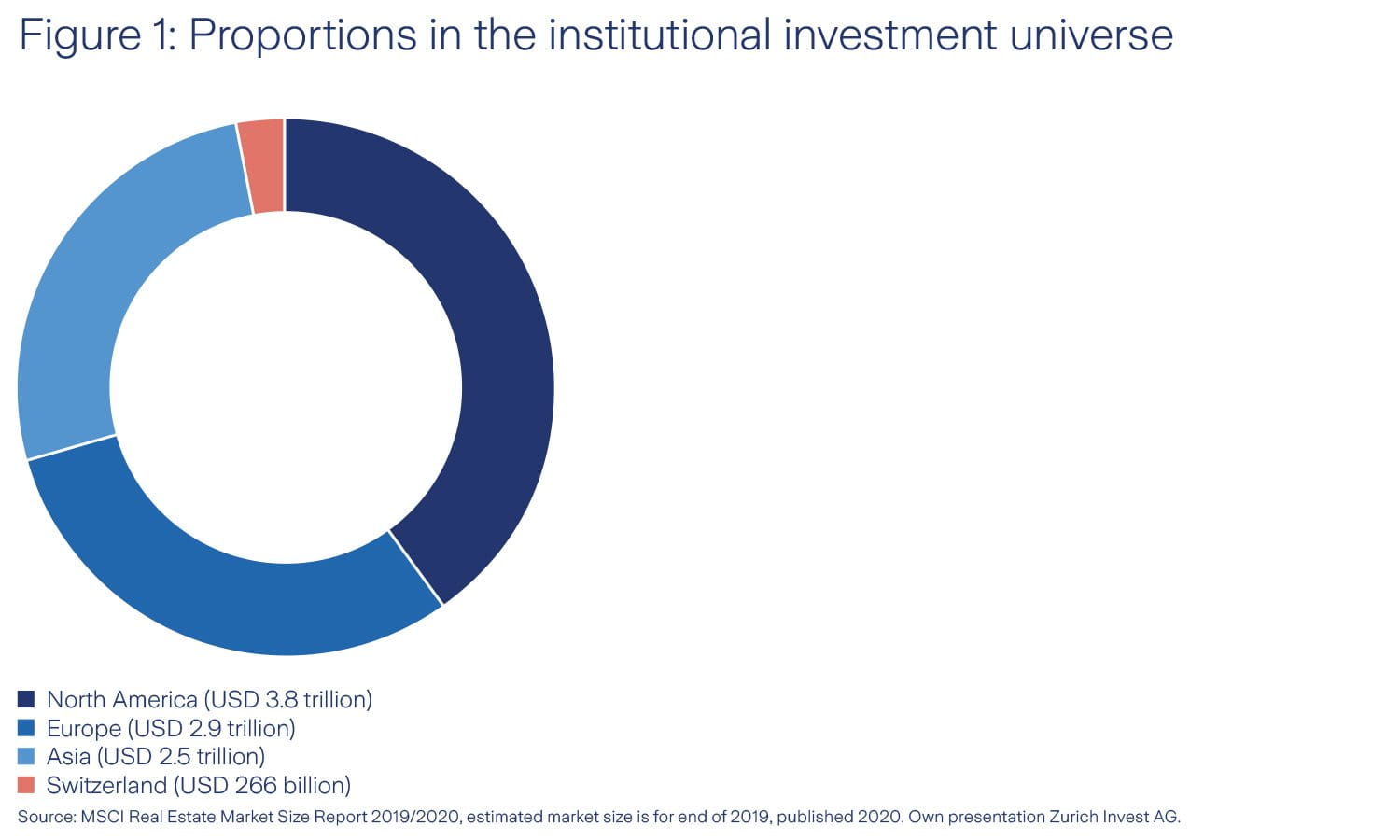

The institutional real estate market in Europe accounts for over 30 percent of the global market and is more than ten times larger than the Swiss real estate market (see Figure 1). Taking into account the current market situation and interest rates, the European real estate market represents a significant opportunity. According to the latest statistics, Swiss pension funds invest 17,5 percent domestically and only 2,6 percent abroad. The upper regulatory limit for real estate investments under Article 55 BVV 2 is a maximum of 30 percent of total assets, of which a maximum of one third may be invested abroad. This clearly demonstrates that there is still considerable investment potential in directly managed real estate abroad.

Using heterogeneity for diversification

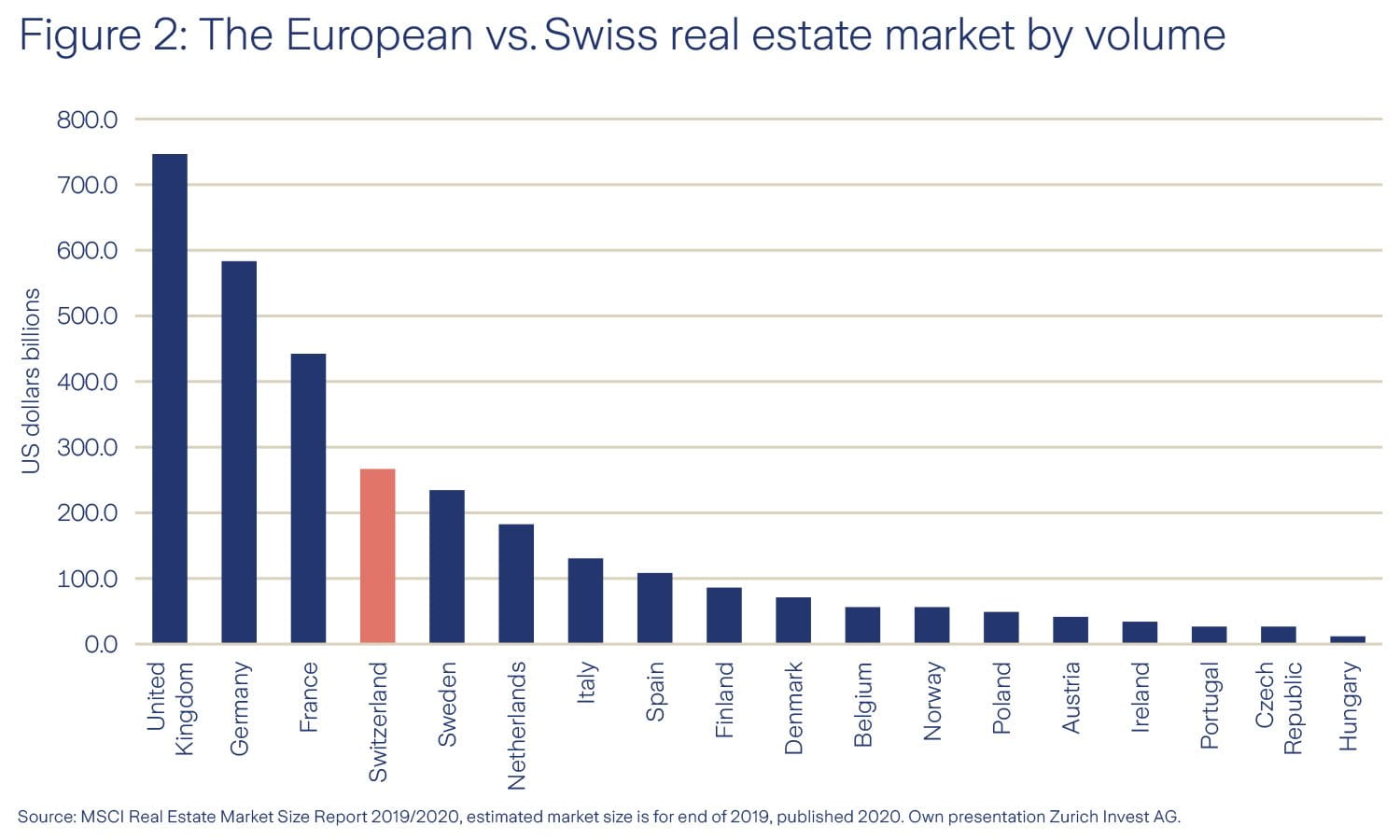

A look at the strongest economies in western and northern Europe is sufficient to achieve a sensible diversification of risks. These include the United Kingdom, Germany and France, which are also the largest institutional real estate markets in terms of volume (see Figure 2). The Benelux and Scandinavian countries also offer interesting opportunities. Italy or Spain can also be considered by pension funds under certain conditions, for instance, if the market environment appears attractive or if there are good opportunities for individual properties. Each market in Europe has its own characteristics with very little correlation, or a high degree of independence in terms of returns. This heterogeneity results in good opportunities for diversification.

The economic sectors also work differently

In addition to country-specific diversification, there is another option for diversifying risks: by investing in different economic sectors. The four most important real estate sectors – offices, retail, housing and logistics – have their own economic cycles and show significant differences in terms of tenant structure as well as capital requirements. This heterogeneity also has a positive effect on the diversification of real estate portfolios.

Winning cities in growth regions

Countries and sectors aren’t the only things that undergo different growth cycles and thus have little correlation. There are also major differences between the individual regions. Real estate located in regions with fast growth – so-called “winning cities” – is particularly attractive. These cities include Berlin, London and Paris. Finding appropriate investments in key European cities and regions does, however, require extensive expert knowledge. After all, it is not just a question of finding the right city, but also an area within that city with a positive development trend.

Know-how and a local network are necessary

Thanks to their high investment volumes, institutional investors have the best access to investment opportunities in the European real estate markets. The challenge for you is to select the right real estate investments from an extensive range. Comprehensive know-how, many years of experience and, above all, an excellent local network of experts are all necessary in order to manage these properties efficiently and properly analyze, structure and successfully complete transactions.

Core/Core Plus real estate is the sweet spot

Core/Core Plus real estate is particularly interesting for real estate investments: These properties are typically in very good locations in cities and have high-quality tenants. Such properties are in high demand because they are centrally located, close to transit hubs and generally accessible facilities. Due to the high demand for such properties, vacancies are usually short-lived and the income streams are very stable across the entire economic cycle. Rents are also often contractually stipulated for many years. Furthermore, the debt ratio is usually low. Currently, most of this real estate is used commercially and offers higher returns than privately used real estate. When it comes to Core/Core Plus real estate outside of Switzerland, investors usually pursue a long-term and stable investment strategy. This means that the investment risks are lower than those associated with other real estate.