Geopolitical challenges, changing global trade dynamics and, in some cases, economic legacy issues in core European markets: the current headlines in the media paint a mixed picture. Despite these uncertainties, however, there are strong reasons to be optimistic about the European core real estate market. The signs here come from fundamental data: Unemployment rates are at record lows across Europe. The German government is launching sprawling economic stimulus packages, while EU partners are generally increasing investment in defense and removing barriers to the single market. The European Central Bank (ECB) is also supporting the economy, as falling inflation and economic uncertainty are enabling faster and deeper interest rate cuts.

This article presents four key reasons why the European real estate market offers cause for optimism. And it explains why working with the right partner with proven expertise is crucial for future success.

1. The real estate cycle is heading for recovery

The year 2024 marked a turning point for European real estate. Inflation is moving toward the target level and interest rates are stabilizing. These developments create the basis for economic growth, with lower interest rates encouraging companies to invest and rising real incomes boosting consumer confidence.

Looking ahead to the second half of 2025, we expect investment activity to increase accordingly as financing conditions continue to improve. Lower interest rates are making real estate investments more worthwhile than bonds again, and the transaction volume is once again increasing. Buyers' and sellers' price expectations are converging – thanks to more stable prices and mark-to-market valuations: It's a picture-book market recovery.

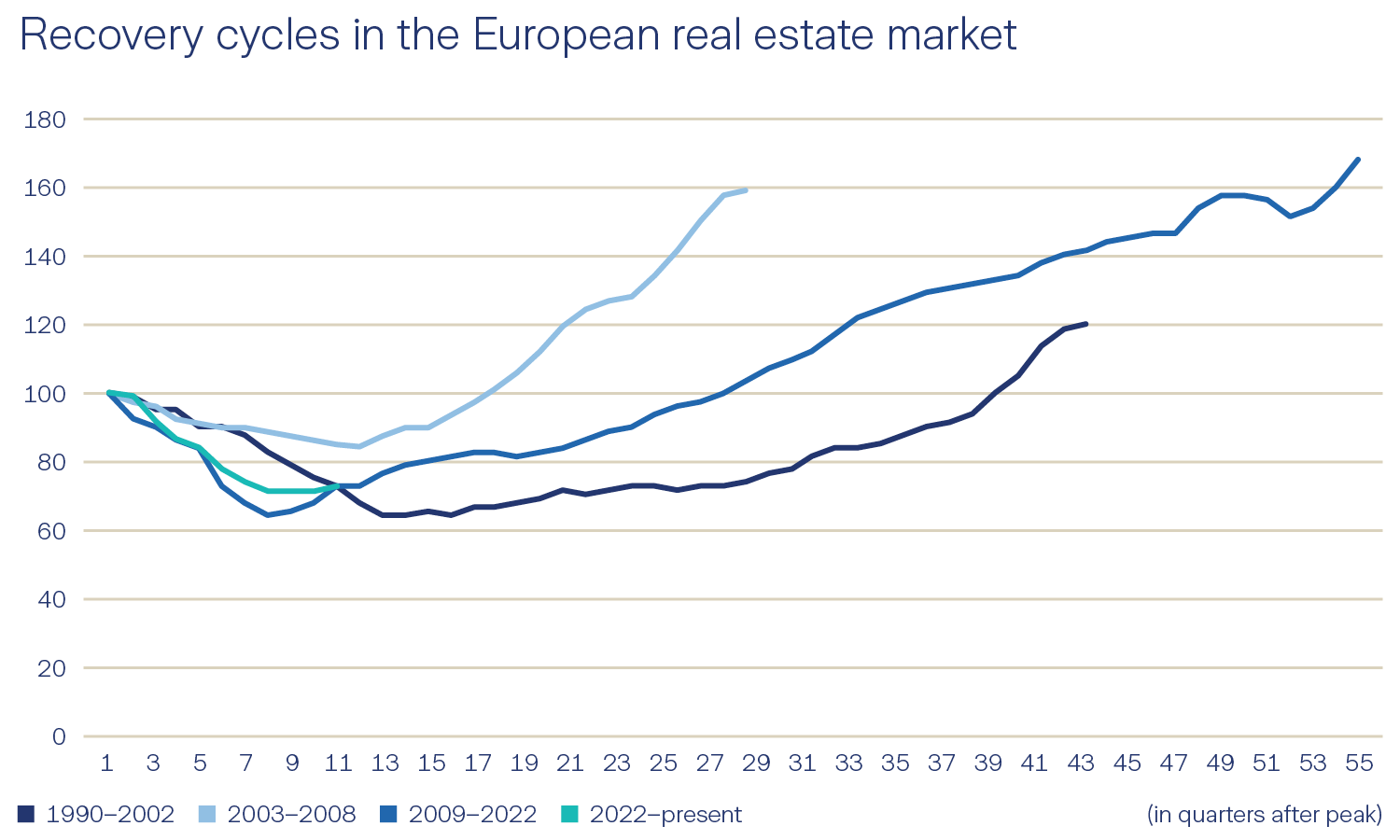

Appearances are not deceptive: the recovery is following a typical historical pattern. Only the exceptional "higher for longer" cycle of the early 1990s took longer, as it was characterized by persistent inflation and an oversupply of space. But these kinds of imbalances are not being seen to a similar extent in almost any European market today, which suggests a faster market recovery in line with previous cycles.

2. Projects are undercapitalized and construction costs remain high

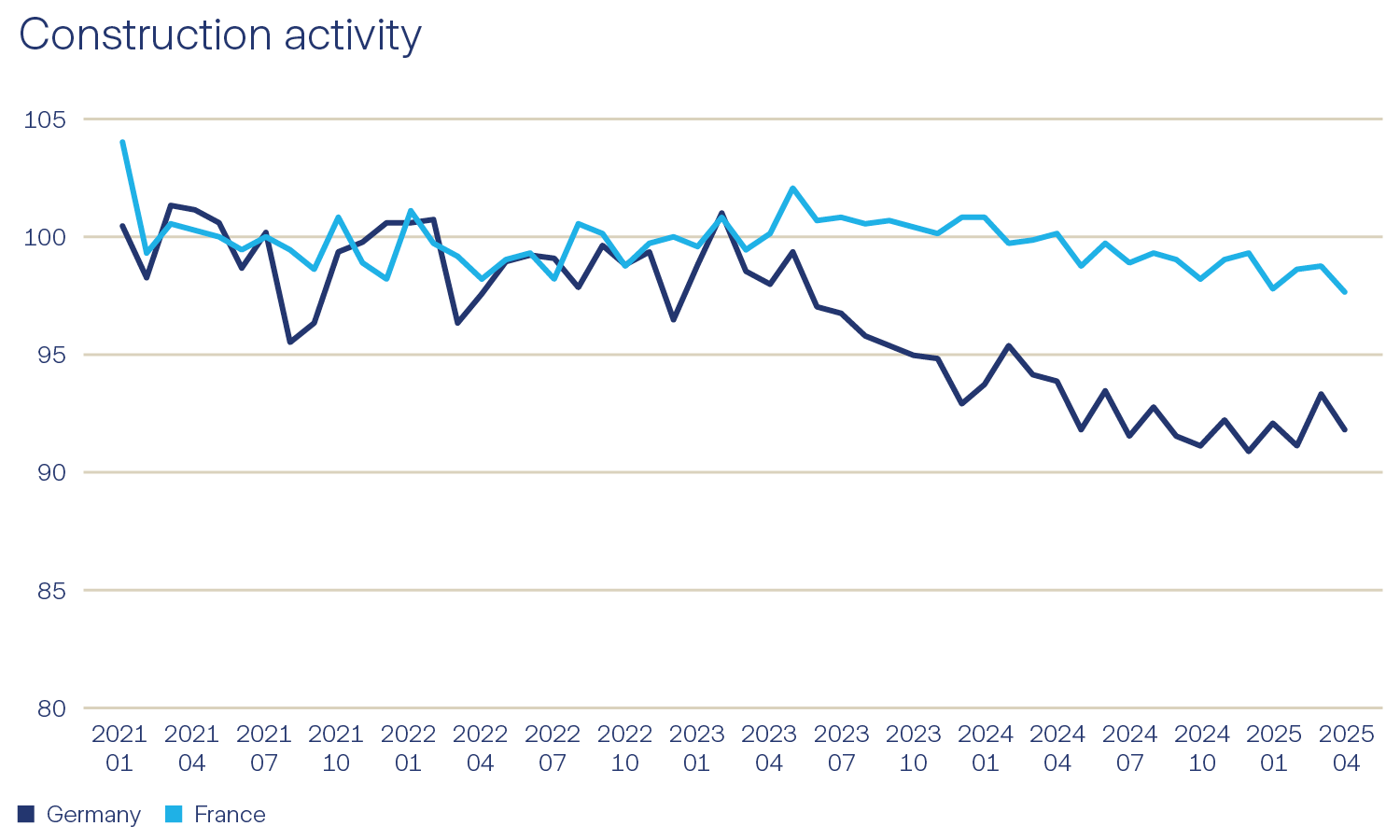

The European real estate sector has seen a significant decline in construction activity since the end of 2021, which is mainly down to two factors. On the one hand, the cost of capital for developers has risen significantly – due to stricter lending criteria and higher interest rates. On the other hand, prices for materials, labor and energy have risen at the same time, which has driven up project costs. As a result, many developments were no longer economically viable.

This has meant that the supply of new projects has fallen sharply on most European markets. In contrast to previous cycles, the risk of oversupply is therefore low and is mainly limited to outdated space concepts. Instead, there is currently a shortage of new, high-quality properties. The low completion rate forms a good basis for satisfactory rental income, with high-quality real estate benefiting in particular, as demand remains high and supply is limited.

3. Structural changes offer opportunities

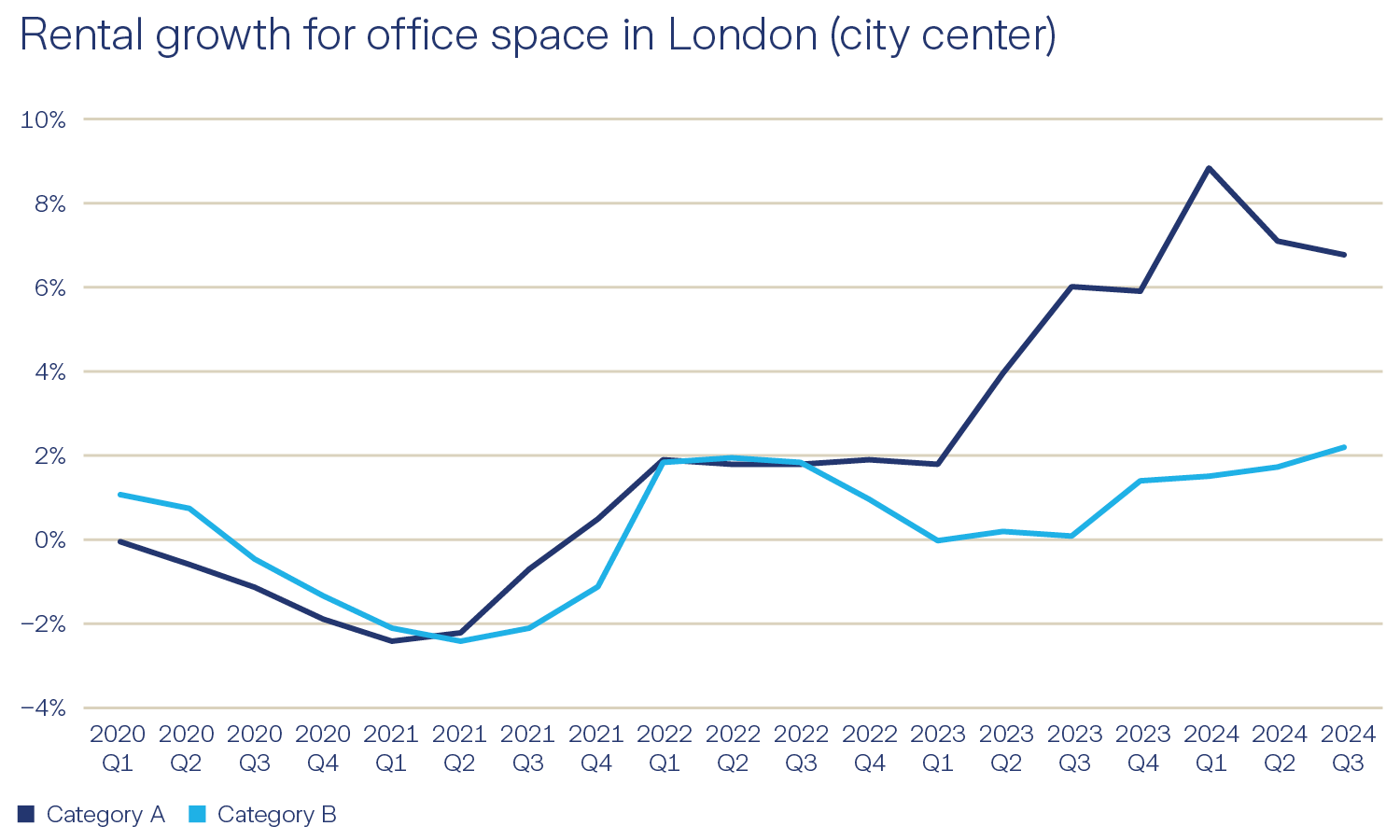

These limits on supply are already shaping important market segments. The pandemic has intensified the rapid change in demand dynamics in the sectors – something that is particularly evident in the office segment. Although the overall supply of space is increasing, partly due to flexible working models, space in central business districts (CBDs) is in short supply. Overcapacity is mainly found in less-sought-after locations and in outdated real estate. In the fourth quarter of 2024, prime rents for offices in London, Paris, Munich, Amsterdam and Frankfurt am Main saw double-digit growth, while rental growth for category B properties remained subdued.

Similar developments can also be seen in the logistics sector: There are indications of stronger letting activity, the stabilization of vacancy rates and sustained demand for prime space. At the same time, demand for properties in the second category is falling. Similarly, the positive trend in the European hotel and tourism sector will continue – particularly in popular, supply-limited markets such as Greece, France, Italy and Spain, which are benefiting from strong international demand. Those who recognize the underlying trends for these developments early on can expect attractive earnings growth.

4. Capital returns to Europe

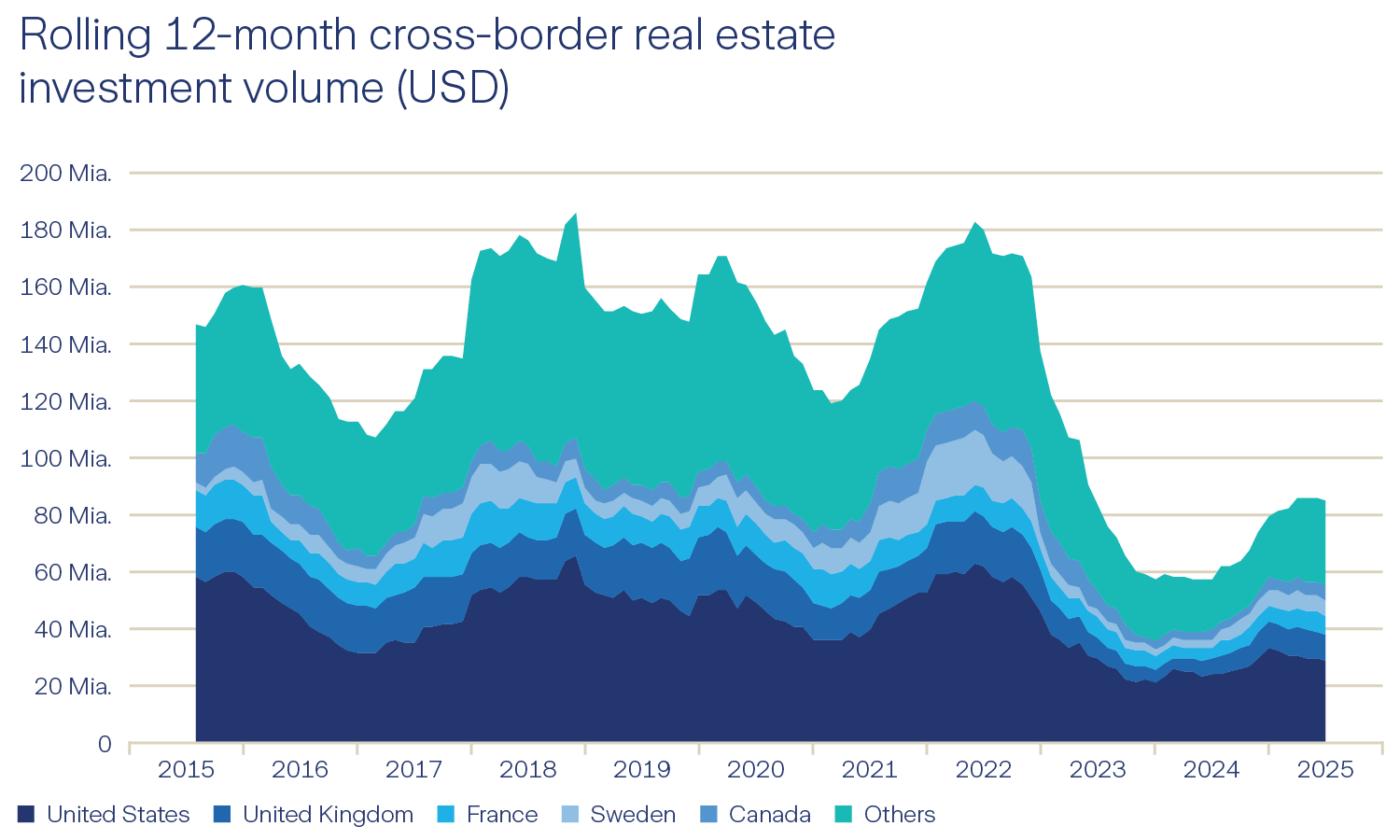

Cross-border investments fell significantly as the market outlook clouded over and transaction activity declined. Yet international capital remains flexible. As market conditions improve, it is returning to Europe – supported by lower euro swap rates and a favorable currency environment for US-dollar-based investors.

At the IPE Real Estate Global Conference in Copenhagen, more than 75 percent of participants signaled their intention to invest more in Europe. Many cited political and economic uncertainty in the USA as the main reason, and a similar picture emerged at the INREV annual conference, where Canadian and European investors in particular announced a shift of new investments to Europe. The market will therefore gain additional capital, which will further support the recovery.

The right partner is more important than ever

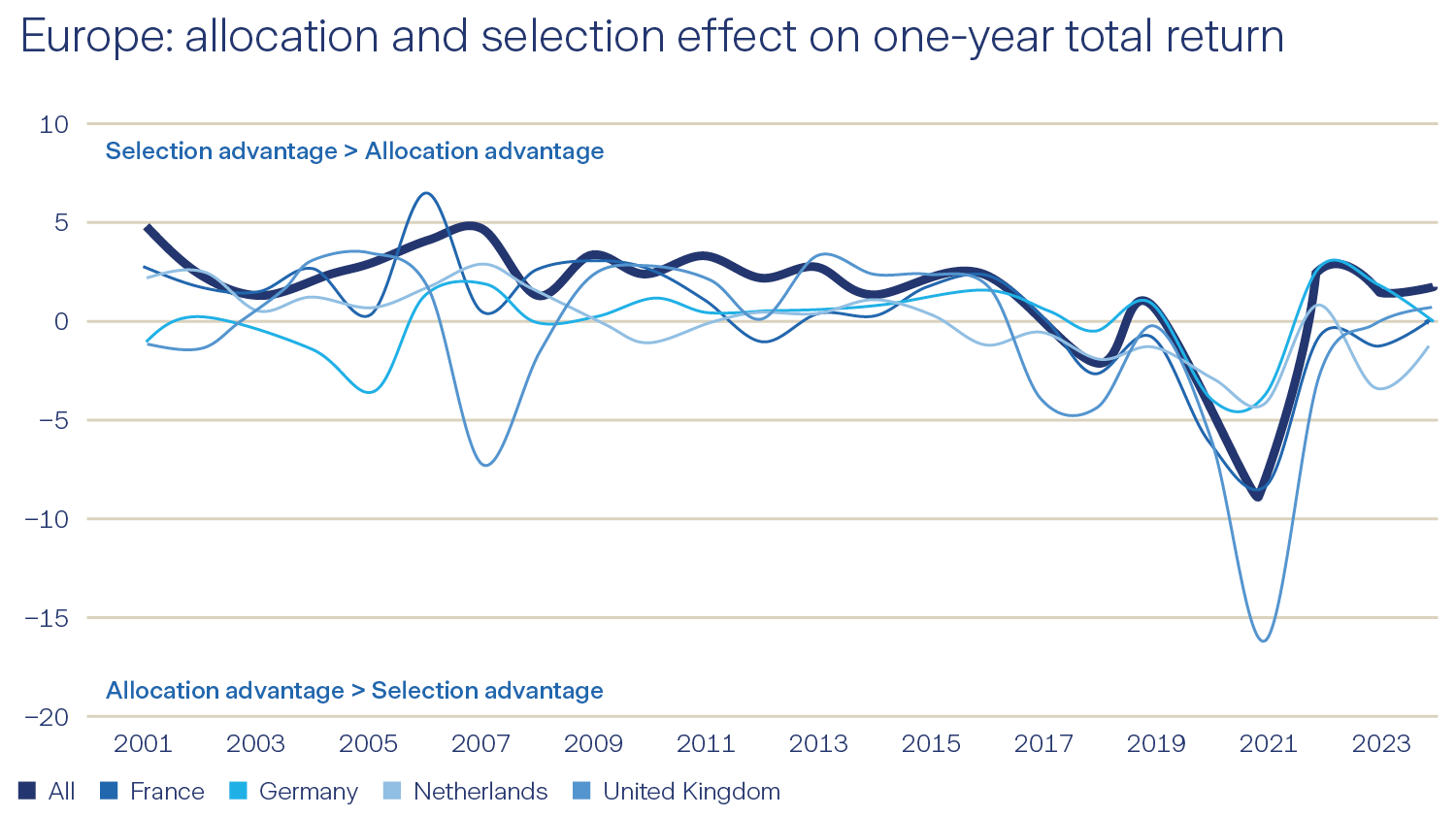

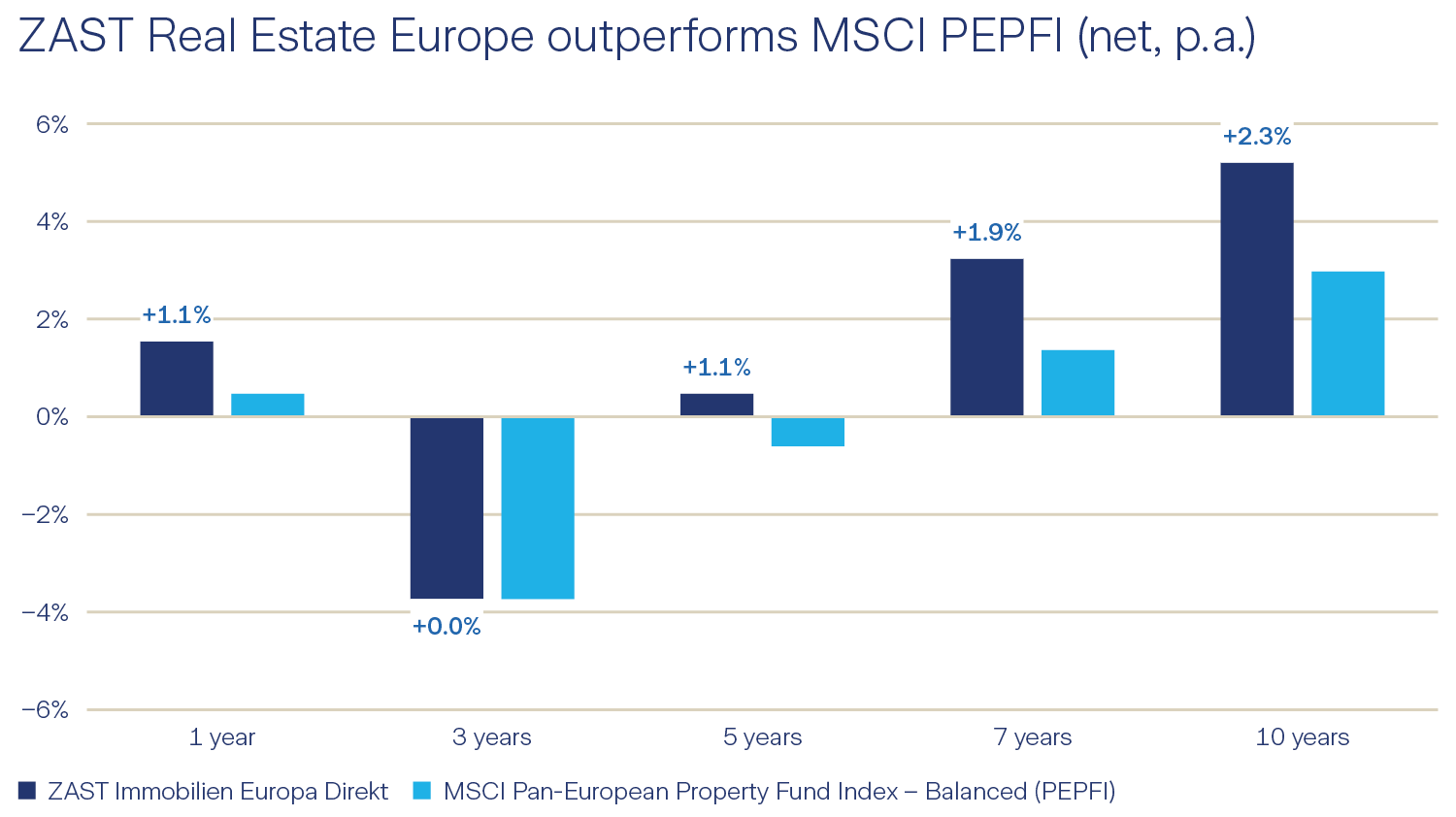

In recent years, portfolio performance has depended on sector allocation to an unprecedented extent, but that is now changing. Successful real estate investment has always been based on the right mix of sector and country allocation as well as the targeted selection of individual properties. The importance of country allocation and, in particular, property selection is clearly increasing again in the new market phase. The task now is to identify the earnings potential of existing and potential assets and to manage exposure accordingly – and to optimize the allocation to those countries where robust economic growth can be expected.