1.3 bn.

Real estate assets under management

in euros

in euros

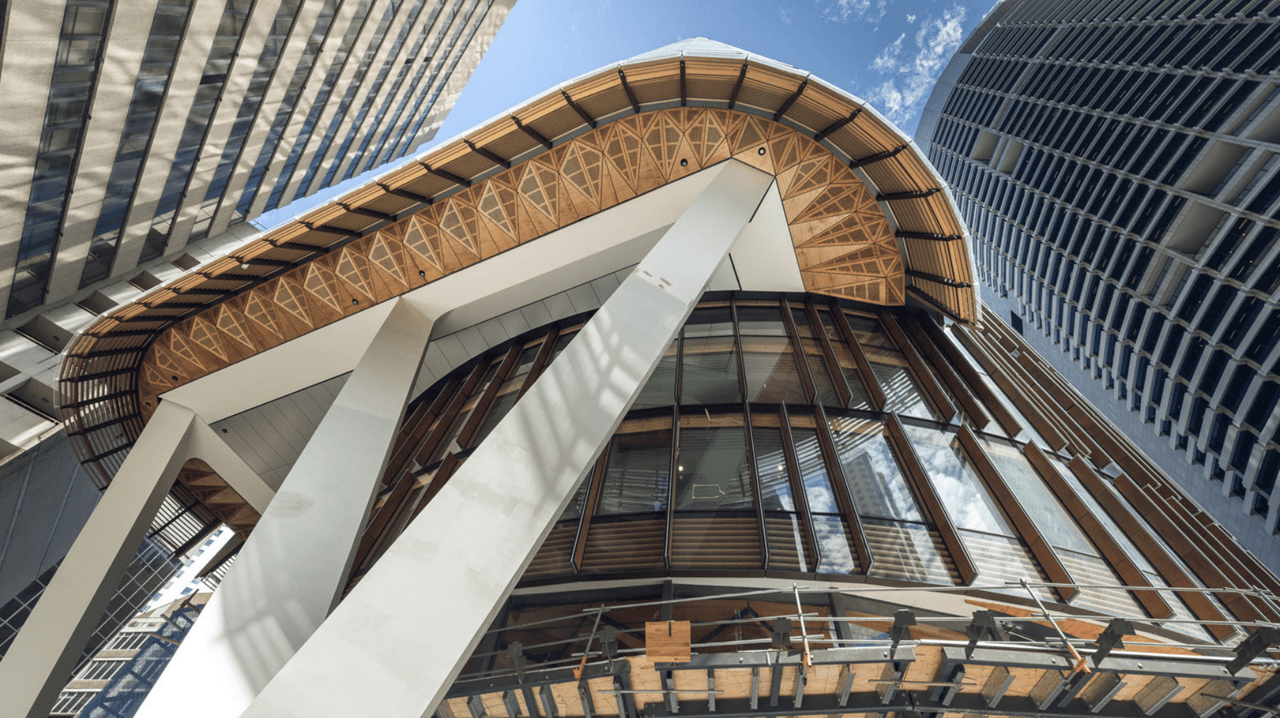

A high-quality portfolio with over 30 properties in above-average locations in the most economically dynamic cities and sectors in Europe.

4,2%

Net yield

The net income yield forms a solid, long-term earnings foundation with an average rental potential of 16 percent.

10+

Years

proven track record

proven track record

Since its launch in 2013, an attractive return has been continuously achieved thanks to local expertise and excellent property selection.

ZAST Real Estate Europe Direct in detail

Your advantages with ZAST Real Estate Europe Direct

Attractive returns and diversification

- More than 30 properties spread across ten countries in above-average locations in the most economically dynamic cities and sectors in Europe.

- Access to a high-quality European real estate portfolio enables stable income returns with potential for capital gains.

- An attractive, secure project pipeline generates sustainable increases in value.

Strong partnership with Schroders Capital

- The investment manager Schroders Capital is a leading European real estate asset manager.

- Schroders Capital has specialized teams in various disciplines spread across all relevant European real estate markets and maintains a unique network of local partners.

Zurich Invest Ltd as the ideal partner with optimal implementation for Swiss pension funds

- The investment group is tailored to the needs of Swiss pension funds. Zurich Invest Ltd (managing director of the Zurich investment foundation) ensures a strong alignment of interests through continuous monitoring and co-determination/veto rights.

- The long-term, risk-conscious investment approach of the Zurich investment foundation ensures the long-term stability and earnings potential of the portfolio.

Schroders Capital: our Real Estate Europe partner

Leading European real estate asset manager

- 30,9 billion euros in real estate assets under management

- Longstanding experience: investing in European real estate for over 50 years

- Over 1’000 properties under management

Team: expertise and stability

- Experienced and stable investment team

- Specialized teams covering various disciplines spread across all relevant European real estate markets

- Owns and maintains a unique network of local partners

Portfolio information

The investment group invests throughout Europe in directly held, predominantly commercial real estate. The investment universe includes the economically strongest countries of Western and Northern Europe, focusing primarily on Germany, France, the United Kingdom, Scandinavia, and the Benelux countries. The investment strategy focuses on direct investments in "core" or "core plus" properties.

Live overview and performance

Sustainability

We are proud of what we have achieved together. Our online report informs you about our strategy, goals, and results.

Find out more about the sustainability key figures for Real Estate Europe here.

Key data

| Asset Management | Schroders Investment Management |

| ISIN | CH0183503272 |

| Benchmark |

none |

| Issue date |

21.12.2012 |

| Fiscal year |

01.01. - 31.12. |

| Currency | Euro |

| NAV per unit | 1'677,86 |

| TER (NAV) | 1,04% |

| Management fee | 0,7% |

Data as of December 31, 2024

All documents

Reach your investment goal with Real Estate Europe Direct

Find out more about the asset class Real Estate Europe Direct. We are happy to assist you.

The best time to invest in real estate was 20 years ago. The second-best time is now.

Learn why now is precisely the right moment to invest in global real estate assets in an in-depth research article by Andrew Angeli, Global Head Real Estate Research and Strategy at Zurich Insurance Company Ltd. Find out more here.

European real estate is back – with plenty of potential

We are living in turbulent times. Nevertheless, there is reason for optimism when it comes to European real estate – if you have the right partner. Find out more here.