Fund size and brand awareness do not guarantee above-average performance

These specialized managers often have in-depth understanding of the market, direct access to attractive transactions, and close operational proximity to their portfolio companies. These factors can have a positive impact on value creation and, ultimately, on performance, but may be underestimated in the selection process by Swiss pension funds.

Active management of private equity: helping to shape, not just own

In an actively managed equity strategy, the portfolio manager attempts to outperform a benchmark. They achieve this by selecting individual shares within an investment universe, weighting them in the portfolio, and through targeted timing of buying and selling. As a rule, the portfolio manager only holds a small stake in the company. Their influence on the company is thus negligible.

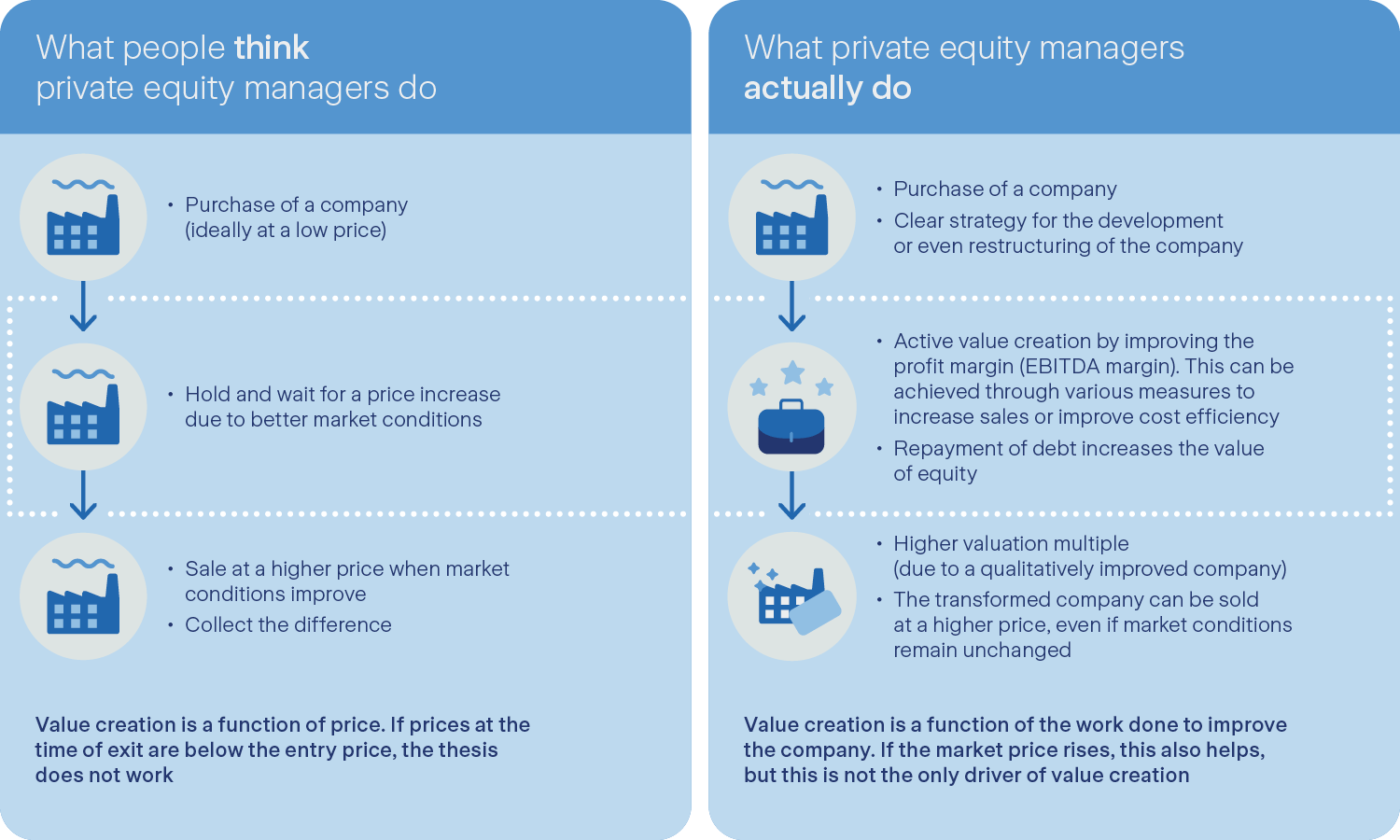

In contrast, the active management of private equity is much more entrepreneurial. The manager typically holds a majority stake and actively influences the strategic and operational development of the company. Value creation is based on three central levers:

- EBITDA growth – for example, by increasing sales, optimizing costs or making targeted acquisitions.

- Multiple expansion – a higher valuation multiple at exit, based on an improved market position and company quality.

- Debt reduction – the repayment of debt capital plays a central role in buyouts, in particular, as it directly increases the value of equity.

This form of active management requires in-depth operational expertise and a strategic understanding of the company's long-term development. Private equity managers are not just providers of capital, but real co-creators – they accompany companies throughout the entire holding period, exert a targeted influence, and actively contribute to transformation and value enhancement.

Helping to shape things, not just buying low and selling high

Hidden costs beyond the classic management fees

Private equity is often associated with the familiar "2/20" fee structure – i.e. 2 percent management fee and 20 percent performance fee from a minimum return of 8 percent, the so-called hurdle rate. However, Swiss pension funds should be aware that the structure of the investment vehicle can have a significant impact on overall costs. One example of this is fund-of-funds structures, which incur a double charge.

While structural costs are often recognized, the impact on the actual design of these fees can be underestimated: Are fees charged on the committed capital or on the invested capital? And how is performance distributed? Is it according to the US deal-by-deal model or the European waterfall model?

In addition, many indirect costs are difficult to identify. However, it is precisely these details that can have a significant impact on the actual costs. It should therefore be a central part of any due diligence to carefully examine the fee mechanisms and indirect costs.

Conclusion: quality is in the details

Private equity offers more than just the prospect of outperformance against equity benchmarks. It provides access to a broader universe of companies, real diversification, and entrepreneurial value creation. A careful analysis of manager quality, strategy and structure is essential.

Comparison of private equity models: US Waterfall vs. European

In the US Waterfall, profits are distributed on a deal-by-deal basis: The fund manager receives his profit share (carry) after the successful completion of individual investments – i.e. not just after the overall settlement of the fund. The prerequisite is that the investors have received their original investment and a minimum return (hurdle rate) from the respective deal.

This model means that fund managers are remunerated more quickly. At the same time, there is a risk for investors that the manager will receive a carry from the individual successful deals, even though the overall performance of the fund is below average.

With the European Waterfall, investors receive their entire invested capital first, plus an agreed minimum return (hurdle rate, typically 8 percent), before the fund manager is entitled to his performance fee (carried interest).

This model is considered investor friendly, as it ensures that investors are fully compensated before the fund manager shares in the profits. For fund managers, this means that they have to wait longer for their remuneration and bear a higher risk of not receiving carry payments if the fund underperforms.