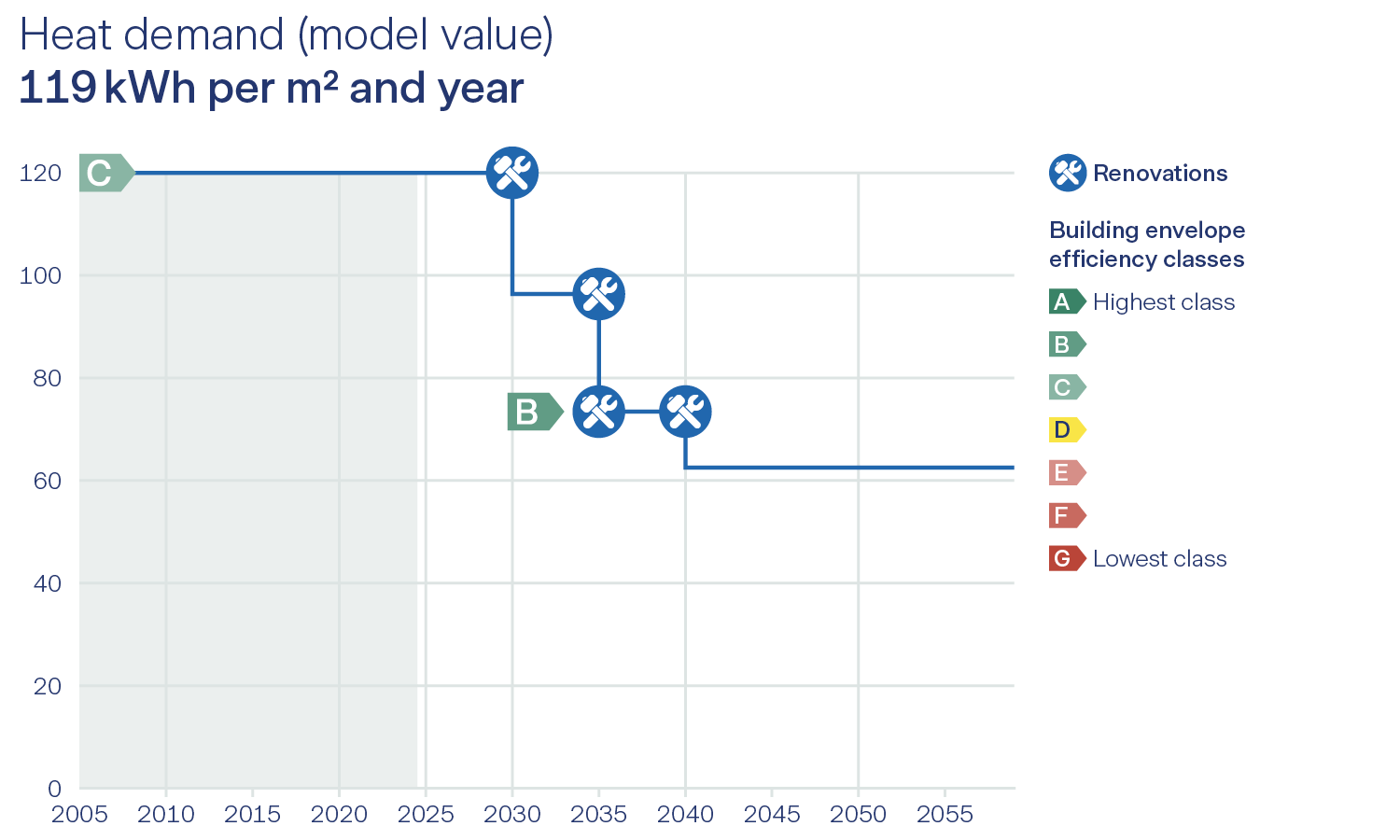

Example of the development of heat demand

Zurich Invest is countering these challenges with innovative solutions and employing cleverly selected incentives for mortgage borrowers: Since the beginning of 2026, it has been systematically using the Wüest Partner renovation calculator to manage its mortgage portfolios. When their mortgage matures, customers receive an individual renovation plan based on the energy status of the building as well as public and internal data. The plan shows how homeowners can improve their energy efficiency. The proposed measures take into account current and forecast CO₂ emissions, energy requirements, operating costs, threshold values and possible subsidies and tax savings. This provides borrowers with a sound basis for making decisions to improve the sustainability of their property and, at the same time, maintain its value in the long term. On this basis, it becomes easier to make renovation decisions and implement specific steps for energy optimization.

With this initiative, Zurich Invest is specifically promoting the decarbonization of its mortgage portfolio. The structural anchoring of the renovation calculator creates transparency regarding the ecological footprint of the financed real estate. This helps to identify risks and potential at an early stage.

The results of the renovation calculator also serve as the basis for the newly introduced green mortgage. Since 2026, borrowers have received an advantageous interest rate if their properties meet energy efficiency requirements based on the cantonal building energy certificate ("GEAK"). This makes energy improvements more financially attractive, regardless of the mortgage model. With the renovation calculator and the green mortgage, Zurich Invest is setting new standards for sustainable real estate financing and actively supporting its customers on the path to an energy-efficient future.