Infrastructure solutions

Infrastructure VI

- Open for subscription Prospectus (German) Certificate of subscription (German)

Using a co-investment approach, the investment group invests in global brownfield investments that generate stable cash flows irrespective of economic cycles.

| Structure |

Closed-End |

| Manager |

GCM Grosvenor |

| First closing |

January 5, 2024 |

| Final closing | 1 year after first closing |

- Investment philosophy: The investment philosophy and service are tailored to the needs of Swiss pension funds.

- Veto right: We represent your interests and take on monitoring, including thanks to our veto right.

- Successful co-investment approach: The Zurich Investment Foundation has successfully applied a co-investment approach since 2013 for infrastructure investments.

Diversification

Target allocation of instruments

in percent

- Main focus on global co-investments of already operational brownfield infrastructure investments

- Core/core+ investments with conservative characteristics for greater stability

- Addition of secondary funds and primary funds possible

- Good diversification across countries, sectors and sponsors

What is a co-investment?

Co-investment refers to a direct investment in a company alongside an infrastructure fund. The infrastructure fund normally holds the majority and the co-investment investor a minority stake in the infrastructure investment.

What are brownfield investments?

What sets GCM Grosvenor apart?

- GCM Grosvenor is one of the world's largest and most strongly diversified asset management companies in the field of alternative investments.

- Experienced, 20-strong infrastructure team

- 8 branches worldwide and investment team with a broad network

- Experience in infrastructure since 2003

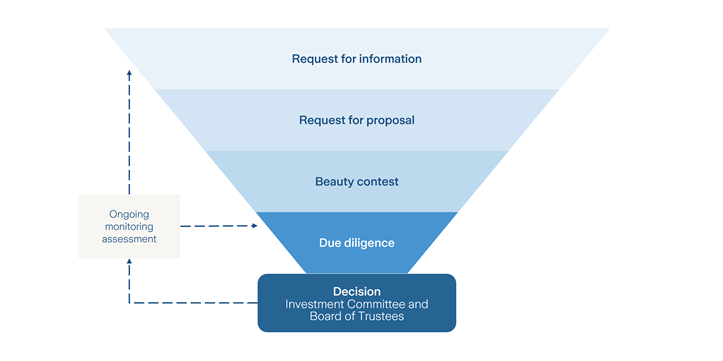

Access to the most attractive opportunities

- Global presence enables access to robust deal flow and so the choice of the best investment opportunities.

- Thanks to good relationships with sponsors, access to high-quality deals is enabled.

- ESG criteria are firmly anchored in the investment process with an additional exclusion list.

| Name | Zurich investment foundation Infrastructure VI |

| Legal structure | Investment foundation under Swiss law |

| Investor group | Pension funds with Swiss domicile |

| Currency | USD, unhedged (currencies are not hedged) |

| Auditor | PricewaterhouseCoopers (PwC) |

| Seed capital |

250 million USD |

| First closing | January 5, 2024 |

| Final closing | 1 year after the first closing |

| Investment period | 3 years after the first subscription period with optional extension by 1 year |

| Term | 12 years after first closing, with optional extension three times by one year |

| Management fee | 1% on the net asset value (not on committed capital) |

| Performance fee | 8% |

| Hurdle | 5% (with full catch-up and clawback) |

| Cap | 10% |

| Expected Total Expense Ratio | 1,5-2,5% (dependent on performance fee) |

Infrastructure Evergreen

- Version unhedged: open for subscription

- Version CHF hedged: open for subscription

The investment group invests mainly in global co-investments with a focus on core/core+ brownfield investments.

| Version |

Infrastructure Evergreen (version unhedged) | Infrastructure Evergreen (version CHF hedged) |

| Manager |

GCM Grosvenor |

GCM Grosvenor |

| First closing | November 23, 2023 |

Planned Q4 2024 |

| Prospectus (German) | Prospectus (German) |

|

| Certificate of subscription (German) |

Certificate of subscription (German) |

- Investment philosophy: The investment philosophy and service are tailored to the needs of Swiss pension funds.

- Veto right: We represent your interests and take on monitoring, including thanks to our veto right.

- Successful co-investment approach: The Zurich Investment Foundation has successfully applied a co-investment approach since 2013 for infrastructure investments.

(version unhedged)

Target allocation of instruments

in percent

- Main focus on global co-investments of already operational brownfield infrastructure investments

- Core/core+ investments with conservative characteristics for greater stability

- Addition of secondary funds possible

- Good diversification across countries, sectors and sponsors

- 100 percent of capital commitments will be invested in private infrastructure assets

What is a co-investment?

Co-investment refers to a direct investment in a company alongside an infrastructure fund. The infrastructure fund normally holds the majority and the co-investment investor a minority stake in the infrastructure investment.

What are brownfield investments?

Brownfield describes infrastructure investments that already exist and that are operational. The returns from brownfield infrastructure investments generally result in particular from ongoing cash flow from operational activities and only to a small extent from capital gains. Infrastructure investments that are still in the set-up stage are referred to as greenfield. Returns from greenfield infrastructure investments essentially result from capital gains.

(version CHF hedged)

Target allocation of all called capital commitments (version CHF hedged)

in percent

- 90 percent private infrastructure investments with main focus on global co-investments

- Core/core+ investments with conservative characteristics and already operational brownfield infrastructure investments for greater stability

- Good diversification across countries, sectors and sponsors

- Cash and Listed Infrastructure for the purpose of currency hedging and reducing cash drag

- 10 percent of capital commitments are only drawn down in the event of additional liquidity requirements for currency hedging purposes

What is a co-investment?

Co-investment refers to a direct investment in a company alongside an infrastructure fund. The infrastructure fund normally holds the majority and the co-investment investor a minority stake in the infrastructure investment.

What are brownfield investments?

Brownfield describes infrastructure investments that already exist and that are operational. The returns from brownfield infrastructure investments generally result in particular from ongoing cash flow from operational activities and only to a small extent from capital gains. Infrastructure investments that are still in the set-up stage are referred to as greenfield. Returns from greenfield infrastructure investments essentially result from capital gains.

What sets GCM Grosvenor apart?

- GCM Grosvenor is one of the world's largest and most strongly diversified asset management companies in the field of alternative investments.

- Experienced, 20-strong infrastructure team

- 8 branches worldwide and investment team with a broad network

- Experience in infrastructure since 2003

Access to the most attractive opportunities

- Global presence enables access to robust deal flow and so the choice of the best investment opportunities.

- Thanks to good relationships with sponsors, access to high-quality deals is enabled.

- ESG criteria are firmly anchored in the investment process with an additional exclusion list.

| Name | Zurich investment foundation Infrastructure Evergreen (version unhedged) | Zurich investment foundation Infrastructure Evergreen (version CHF hedged) |

| Legal structure | Investment foundation under Swiss law | Investment foundation under Swiss law |

| Investor group | Pension funds with Swiss domicile | Pension funds with Swiss domicile |

| Currency | USD, unhedged (currencies are not hedged) | CHF, hedged (currencies are hedged for the most part) |

| Auditor | PricewaterhouseCoopers (PwC) | PricewaterhouseCoopers (PwC) |

| First closing | November 27, 2023 | Planned: Q4 2024 |

| Investment period | 4-year initial portfolio build-up | 4-year initial portfolio build-up |

| Management fee | 1% on the net asset value (not on committed capital) | 1% on the net asset value (at target fund level for private infrastructure) plus 0,1% on the net assue value of the investment group |

| Performance fee | 8%1 |

8%1 |

| Hurdle | 7,5% (with full catch-up and clawback within 4-year accrued periods) | 7,5% (with full catch-up and clawback within 4-year accrued periods) at target fund level |

| Expected Total Expense Ratio | 1,5-3% (dependent on performance fee) | 1,5-2,9% (minus possible discount during the build-up phase) |

1 Performance fee on the underlying private infrastructure target fund and based on its USD unhedged performance.

Redemption

Redemption requests must be submitted at the end of each year, for the first time as of December 31, 2025. Repayment generally within 2 years (with 2-year extension option if required).

Details on the redemption and repayment modalities can be found in the:

- Prospectus (German) – Infrastructure Evergreen (version unhedged)

- Prospectus (German) – Infrastructure Evergreen (version CHF hedged)

Infrastructure programs already launched

| Infrastructure V | Performance |

| Infrastructure IV | Performance |

| Infrastructure III | Performance |

| Infrastructure II | Performance |

| Infrastructure I | Performance |

Would you like a consultation?

We will be happy to help.