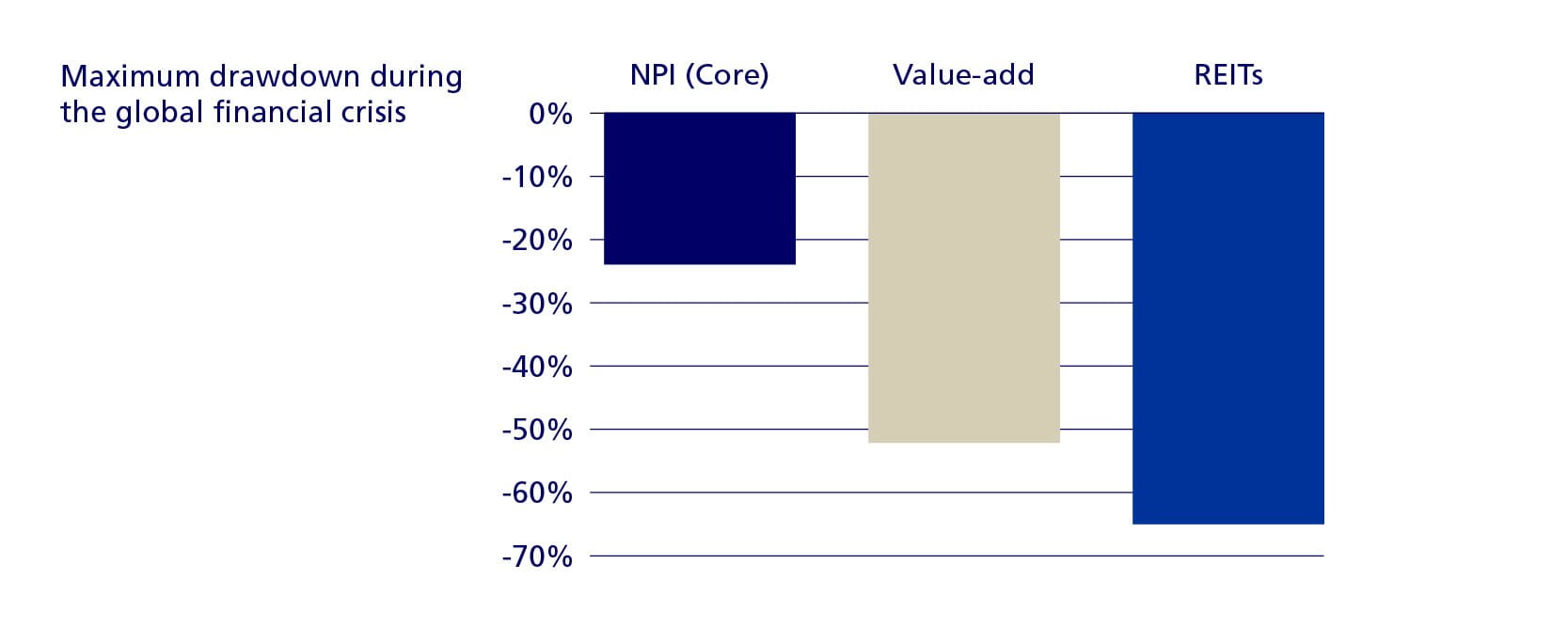

The world’s biggest real estate market

The US institutional real estate market is the biggest real estate market in the world. With 2.7 trillion US-dollars, the American real estate market is almost four times the size of the second-placed Japanese market. What’s more, the US real estate market is almost as large as the markets of Japan, Great Britain, Germany, China, France and Hong Kong combined (see Figure A). The USA offers a market with significant investment opportunities that are diverse and attractive.Liquidity par excellence

The US records a huge volume of transactions: Every year 300 billion US-Dollars’ worth of real estate changes hands, and this average remains consistent across the full economic cycle. Hence, in 2017 for example, more than 22 percent of global transaction volumes flowed within the US. If you compare the average transaction volumes of 300 billion US-Dollars with the annual gross domestic product of Switzerland, which is around 680 billion US-Dollars, then you get an idea of the magnitude of this volume.A high level of transparency makes price negotiations easier

When it comes to transparency too, the American real estate market is a shining example. In the US, statutory framework conditions, high standards with regard to data availability and quality, and frequent performance measurements with high demands ensure outstanding transparency. Similarly, the central Multiple Listing Service (MLS) contributes to an open exchange of information: The real estate information system presents the existing offering of real estate with sale prices by way of an overview, hence suitable properties are easy to find and compare. At the same time, price negotiations are made easier, because both buyers and sellers have access to the same information.US real estate market: Ideal attributes for diversification

The US real estate market offers Swiss investors three very significant diversification attributes:

- Low correlation

The correlation of the yields between the different markets is relatively low. Over the period between 2003 and 2016, for example, the American real estate market showed a correlation of 0.23 compared to the Swiss market and 0.33 compared to the German market. - Huge market volumes

Thanks to its commercial magnitude and the broadly based positioning in different industries, the American real estate market offers a high level of growth in rental income compared to other markets. - Diversified real estate portfolio

The four most important real estate sectors – offices, retail, residential and logistics – are represented in various economic sectors and show considerable differences in terms of both tenant structure and capital requirements. They thus make a significant contribution to the diversification of a real estate portfolio.

All these positive attributes can help investors to build up a well-diversified international real estate portfolio, with the aim of reducing the cluster risk that arises for most Swiss pension funds which are strongly anchored in the home market. Incidentally, along with the ideal diversification prerequisites, there are other reasons to invest in the American market: The US market is very resilient, for example, and the yields from the core real estate are very stable.

Resilient in times of crisis

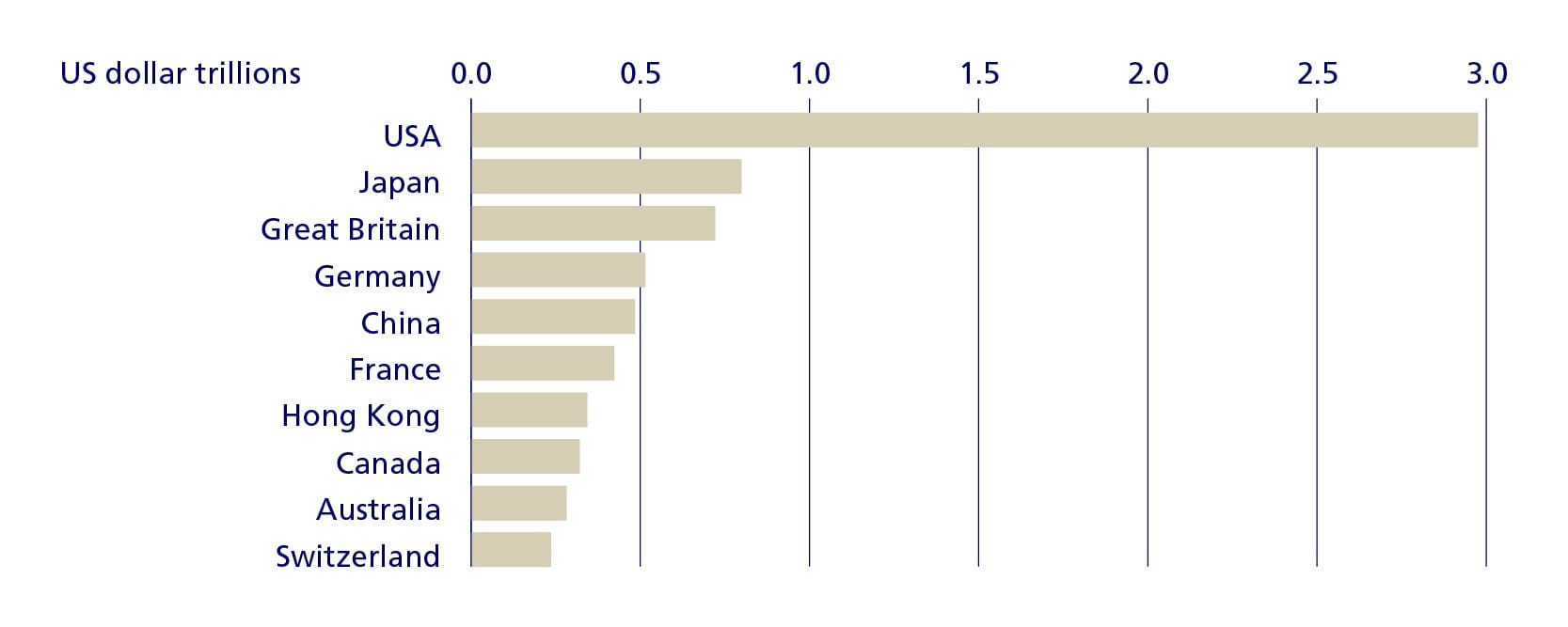

As the world’s biggest real estate market, the US market should be considered an essential component of an internationally and broadly diversified real estate portfolio. The resilience of such investments was evident even during the financial crisis. Over the course of the crisis, real estate funds and REITs (Real Estate Investment Trusts), which behave similarly to shares, suffered very heavy losses. At the same time though, directly held properties were significantly more resilient (see Figure B).

Robust with US core real estate

It is primarily core real estate investments that sit at the bottom of the risk ladder. These are typically in prime locations in city centers and have quality tenants. These sorts of properties are located close to traffic hubs, public institutions and, in the case of logistics plants, close to highways and other transport arteries. Furthermore, yields from core real estate are very stable over the course of the entire economic cycle, because properties are typically only vacant for a short time and tenancies are often established contractually for a number of years. Financing basically takes place with low quotas for foreign capital. With core properties, investors pursue a long-term and robust investment strategy.

Profound expert knowledge is essential

Thanks to their high investment volumes, institutional investors have optimum access to investment opportunities across all markets worldwide. The challenge really is to choose the right investment among the many that are available, hence expert, real-estate-specific knowledge, experience, and, most importantly, a good local network and management are indispensable when it comes to managing properties efficiently, analyzing and structuring transactions correctly, and ultimately executing them successfully.

Don't wait to buy real estate, buy real estate and wait.

T. Harv Eker, Canadian author and entrepreneur

The US institutional real estate market is the biggest property market

Significantly lower extreme risk with core real estate