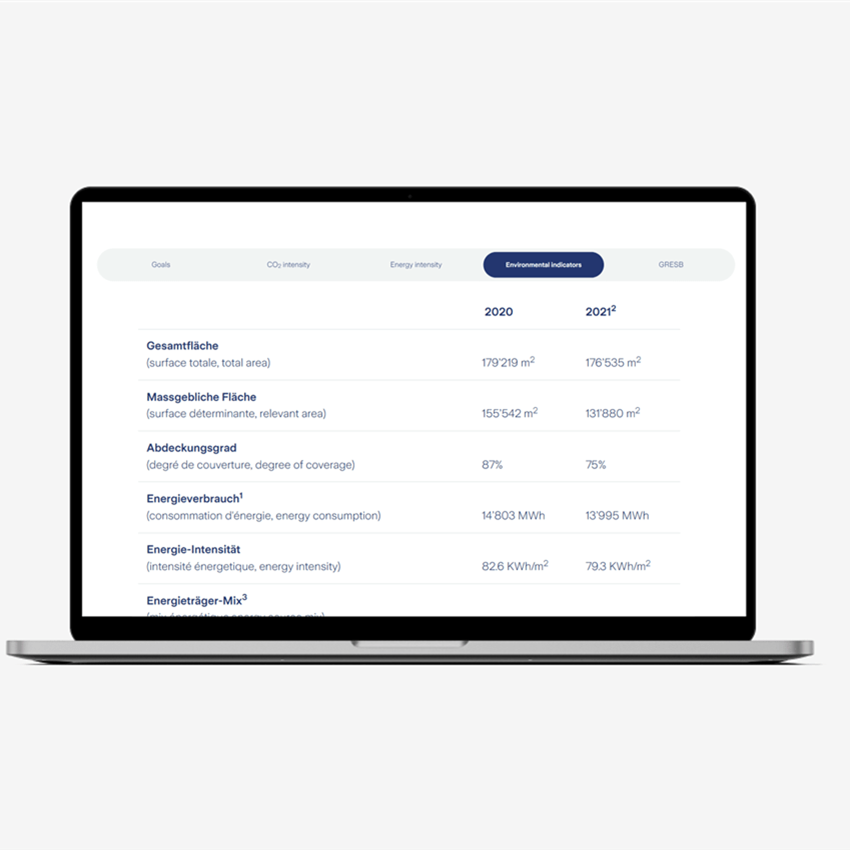

Our online report provides information on the environmentally relevant key figures for Swiss real estate and now shows a year-on-year comparison of the key figures for equities and bonds.

Last May, the Asset Management Association Switzerland (AMAS) issued a recommendation for the calculation of environmentally relevant key figures for real estate funds under Swiss law. This recommendation was adopted by the Conference of Managing Directors of Investment Foundations (KGAST) in September 2022.

Environmentally relevant key figures published for Real Estate Switzerland

Zurich Invest Ltd. is already publishing the environmentally relevant key figures for the 2021 reporting year in accordance with the AMAS recommendations. In this way, we increase transparency for our investors and are committed to comparability with other real estate vehicles.

Significantly more engagement activities compared to the previous year

The corporate response to climate change and the associated opportunities and risks has increased the importance of engagement dialogues. Investors are placing increasing emphasis on ensuring a company's long-term success while continuing to raise its awareness of social responsibility.

In 2022, our external asset managers conducted an active engagement dialogue with around 860 companies in the equity and bond funds, compared to 691 the year before.